Pandemic Bill Would Cut Taxes By An Average of $3,000, With Most Relief Going to Low- And Middle-Income Households.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9637985/table_3.png)

The numbers are in, and the House Republican tax bill raises taxes on over a quarter of Americans - Vox

The Tax Policy Center Weighs in on How the Federal Tax System Has Affected Growing Income Inequality and How Reform Could Help - BadCredit.org | BadCredit.org

New report from Urban-Brookings Tax Policy Center reveals how COVID-19 is affecting the fiscal health of states - Avalara

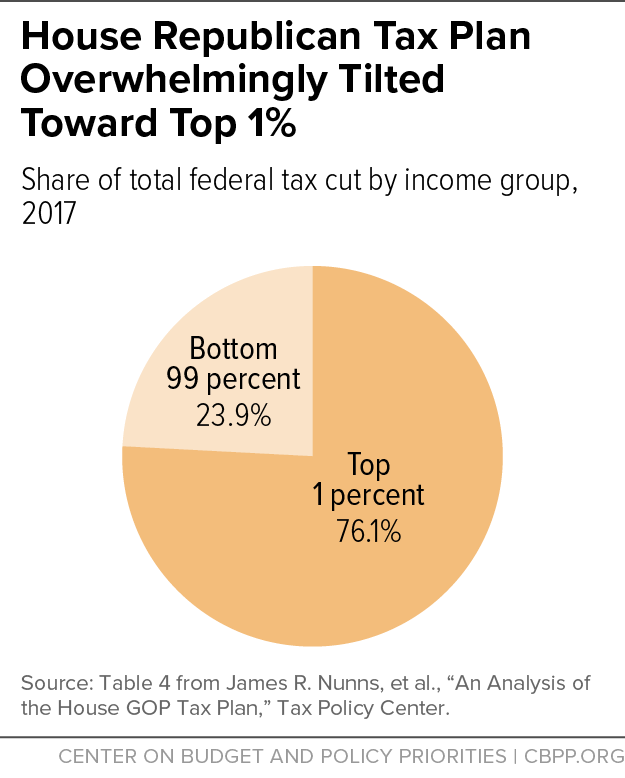

House GOP “A Better Way” Tax Cuts Would Overwhelmingly Benefit Top 1 Percent While Sharply Expanding Deficits | Center on Budget and Policy Priorities

Tax Policy Center™ Serves as an Independent Watchdog for U.S. Leaders and the Public on Tax and Budget Policy - CardRates.com

/cdn.vox-cdn.com/uploads/chorus_asset/file/9637981/graf_1.png)

The numbers are in, and the House Republican tax bill raises taxes on over a quarter of Americans - Vox